Case Studies | Non-Banking Finance Corporation and Banking

- Electronic Postal Service - Lombard Business Finance, UK

Implemented an Electronic Postal Service (EPS) process automation solution using the BPM platform to automate the delivery of agreements, correspondence, securities information, and supporting internal documents to the operators for processing the loan application.

The Client

Lombard Business Finance, a division of major financial services group, United Kingdom

Industry

Financial Services

Challenges

There was lots of manual movement of the documents to different roles within the organization. No automated way to handle quality check, to remind, to escalated any delayed as per SLA and rule associated with the current state of documents within the EPS process. It was not easy to control operator load and performance at each step along the process.

Solution

PERICENT has implemented a complete solution as an automated electronic postal system to manage the distribution of cases to the operations team with specific roles and other parameters.

The solution has made it easy for the route of case documents within the processing team. Also, we improved the coordination between the client and document processing service company through timely notifications and alerts. At the same, performance tracking is also improved at each work step along the process via various management reports.

Business benefits

With such a process automation solution to handle financial documents processing more managed, cost-effective and timely delivery of services as per defined SLA.

Also, the distribution of cases is automatically handled based on configurable roles and rules. The access strategic reports and real-time process status also become quite easy to analyze the case.

Technology Used and Architecture

BPM platform – SBM 7.b SP2, Java/J2EE, Bootstrap JS, Web-Services, Oracle 10i.

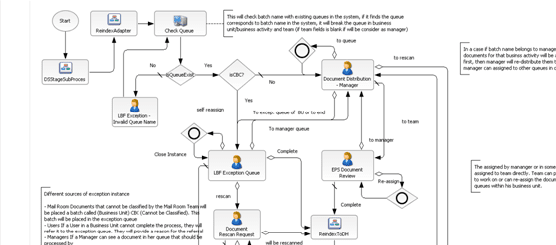

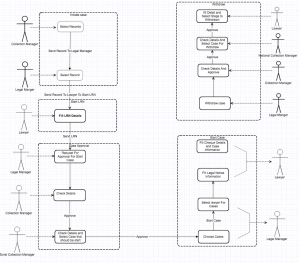

Process Model

Here is the work-flow model of the EPS solution.

- Statuary Document Services - Lombard Vehicle Management, UK

Challenges

Initially, statuary documents requests are getting placed manually via emails by statuary document owner to Anacomp UK Limited, a document management company and there was no efficient way to keep track of activities of the process. Again, it was quite difficult to ensure timely delivery of statuary documents of the vehicle from DMS service company to place of request and track the return back to the document warehouse.

The Client

Lombard Vehicle Management (LVM), United Kingdom.

Industry

Financial Services

Solutions

Implemented an automated Statuary Document Services (SDS) solution to quickly process an online request for statuary documents of the vehicle, and to track the movement of these documents from the archival company to a particular destination and.

This automation solution to service statuary documents request/retrieval/ return/ dispatch using Savvion Business Manager™. Apart from the automation of online request capture, it has also improved in the execution of the statuary document archival and retrieval processes.

Business benefits

The solution made it easy for the vehicle owners to just do an online request from anywhere anytime. Also, accountability of all requests processing status including complete monitoring, easy tracking, record movement of the document, TAT, SLA, and history.

Technology Used and Architecture

BPM platform – SBM, Java/J2EE, Bootstrap JS, Web-Services, Oracle 10i.

- Legal Process Automation, Reliance Capital, India

Reliance Commercial Finance had a need to keep track of the huge volume of the legal cases for loan defaulters, manually it is becoming very challenging for the legal team of Reliance Capital to keep track and handle these long-running cases manually in good volume.

The Client

Reliance Capital (NSE/BSE Listed Company)

Industry

Financial Services

Challenges

- Manually, very challenging to track of legal notices to the defaulter, which has got 90+ DPD.

- Difficult to keep track of the closing of the legal process once the client has made the payment.

- Again, the coordination between assigned/update of the lawyer and legal team of reliance about the status of the cases in the court.

- And, the certain case runs for the years, it was challenging to manage them manually.

Solutions

- Now, as soon as DPD is due 90+, a legal process gets auto-start and assigns to the work queue of the legal manager.

- It allows you to close the legal process as soon as the client makes the payment of EMI.

- You can further assign the lawyer, here lawyer can also access the application to update the status of cases.

- It allows you to track the next court case as per the update of the case done by an assigned lawyer.

- The legal team can view the complete status of the various legal case in court.

here are few of functions in Legal Process Automation

- Start the LRN Process

- Lawyer section

- Start Approval case in the Legal Manager report

- Collection Manager Login

- Cases passed to the Zonal Collection Manager (ZCM/RCM)

- Check the Cases in Legal Manager Report

- Start the Cases in Legal Manager Report

- Assign a Lawyer

SECTION 138 - Send Legal Notice for Section 138

- Fill Cheque Details for Section 138

- Legal_Case_Sec 138

SECTION 9

- Send Legal Notice for case Section 9

- Legal_Case_Sec9

ARBITRATION

- Send Legal Notice for case Arbitration

- Legal_Case_fill_Arb

- Legal_Case_Arb

WINDING UP

- Send Legal Notice for case WindingUp

- Legal_Case_Fill_WindingUp

- Legal_Case_WindingUp

CRIMINAL COMPLAINT

- Send Legal Notice for case Criminal_Complaint

- Legal_Case_Criminal_File_Complaint

- Legal_Case_Criminal_Complaint

WITHDRAWAL PROCESS

- Collection Manager

- Withdrawal case then passed to National Collection Manager (NCM)

- Check the Withdrawal Cases in the Legal Manager Report.

Business benefits

- User-friendly application for an organization to track legal operations by the legal team.

- Real-time Dashboard to view a summary of cases and their status.

- The legal team is automatically getting a notification and tasks in work queue when EMI DPD goes 90+ by fetching data from LMS

Technology Used and Architecture

The system is built on BPM platforms.

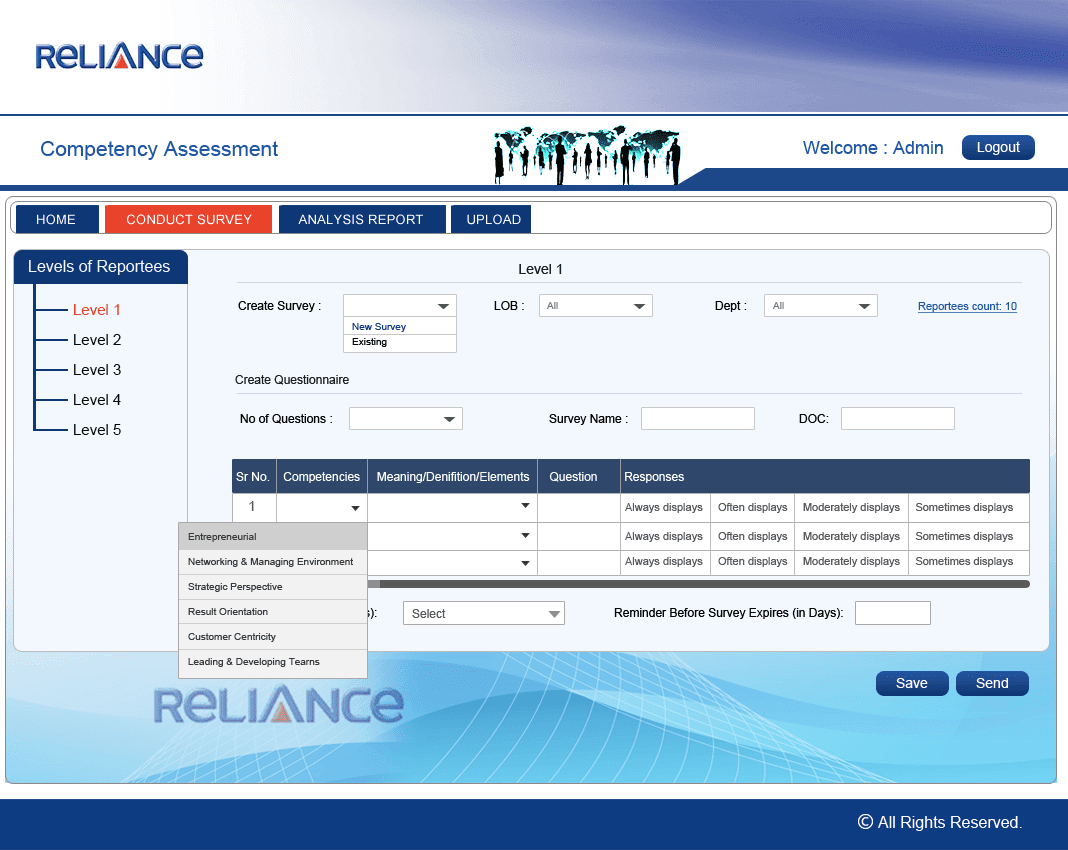

- Competency Assessment, Reliance Capital Limited, India

There was need to automate the process of performance analysis of the employees in the organization by their respective reporting managers.

Manually, it was more quite time-consuming, overall as a list of questions needs to be set up, in the form of a questionnaire, for the employees according to their department and level and will be sent to all employees for their responses.

Finally, by analyzing the responses of the employees, they will be judged on the basis of 6 competencies and 17 behaviors.

The Client

Reliance Capital (NSE/BSE Listed Company)

Industry

Financial Services

Challenges

- Manual assessment of all the employees of the organization takes a lot of paperwork and time.

- Challenging to maintain the detail records and responses of the employees as well as of their respective managers for longer use.

- A lot of time consumption of managers to interact with all of their employees for their performance analysis.

- It requires a lot of effort to manually manage and creating a questionnaire for different departments and different leveled employees.

Solutions

- Option to upload details of the employees and their respective reporting managers.

- Functionality to decide a total number of questions and creation of questionnaires according to the level of the employee.

- Facilitate to send survey forms to the employees and maintain their responses.

- Maintain a check of not responded questionnaire forms and the employees left for assigning the questionnaire.

- Setting up reminders for the managers to fill up their responses regarding all their employees.

- Viewing the Daily Analysis Report of the employees and responses of the managers.

Business benefits

- User-friendly application for an organization to perform a competency assessment of its employees.

- Organizing the personal details and questionnaire responses of all the employees in a systematic and easily accessible order.

- Maintaining the details of all the department managers of the organization along with their ratings of their respective department employees.

- Creating the questionnaire for the employees as per their department and position level.

Technology Used and Architecture

The system is built on BPM platforms.

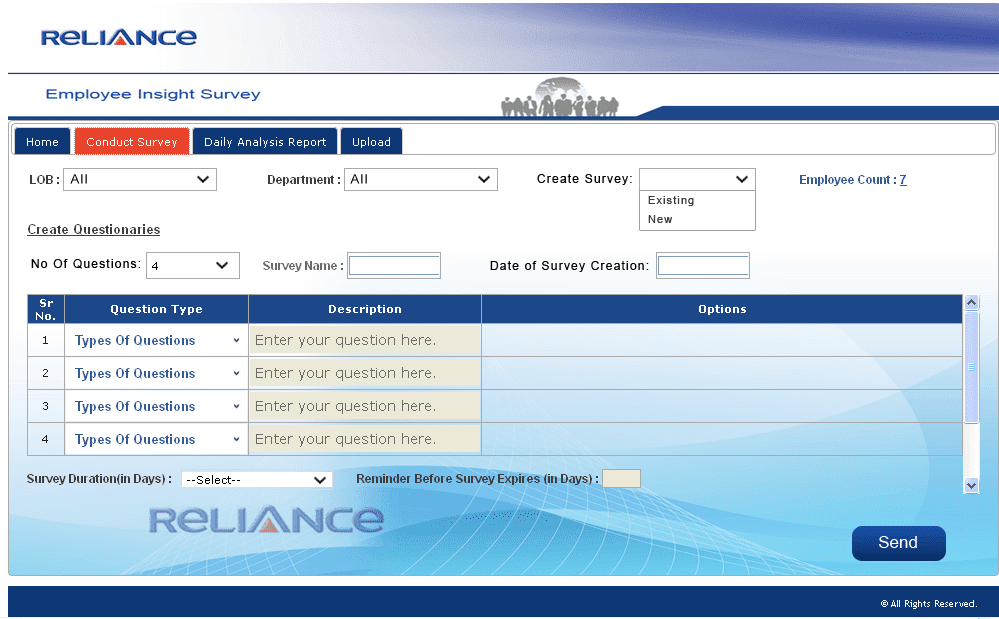

- Employee Insight Survey, Reliance Capital Limited, India

Employee Insight Survey facilitates the Human Resource (HR) department of Reliance Capital to perform a survey of their respective employees.

Basically, the system automates sending survey forms by the HR department to all the employees and monitor the progress, searching through email id or SAP id. Once the survey form is sent to employees, the window will remain open for 10-15 days allowing employees to submit their responses.

The Client

Reliance Commercial (NSE/BSE Listed Company)

Industry

Financial Services

Challenges

Earlier, HR needs to take surveys manually but after this application, they can take the employee’s surveys through online forms. Hence this was the problem that is solved by this system. The purpose is to build an application for “Employee Survey” to manage overall activities related to the conduction of employee surveys.

Solutions

This solution made the survey process easier, faster, easy to set up a survey. It becomes simple to keep track of each survey form.

Business benefits

- Options to upload the details of the employee. Option to create the questionnaire and define the type of question to be created like comment box, true or false, etc. To assign the survey forms to the required number of employees on LOB or department basis.

- Automatic reminder to the employees to fill the survey form and submit it. The option of viewing the daily analysis report to HR. View the responses of the employees. Option to download the responses of the employees in the excel format to create new lob and new departments as and when required.

Technology Used and Architecture

BPM platform, Java/J2EE, Bootstarp.

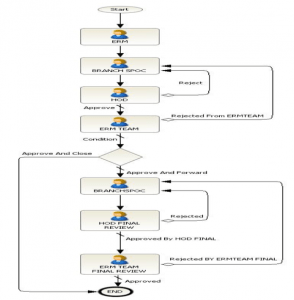

- Audit Tracking Process, Reliance Capital Limited, India

Reliance Commercial finance wanted to automate Audit tracking process on BPM platform

The Client

Reliance Commercial (NSE/BSE Listed Company)

Industry

Financial Services

Challenges

Manually, it was challenging to keep track of the preparation of audit reports, time-consuming and coordinate with all.

Solutions

This process revolves around three performers’ i.e. auditor, respective process SPOC / coordinator and process owner.

It covers the preparation of a report by auditors, showing compliance and rating (NC/observation/ compliance / OFI) with findings. It also covers the approval process of submitted planned actions to mitigate the non-compliance provided by the SPOC, until the final implementation of suggested mitigation measures through various levels of approvals at the branch level.

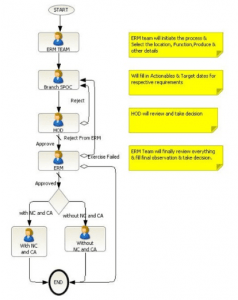

Process Model

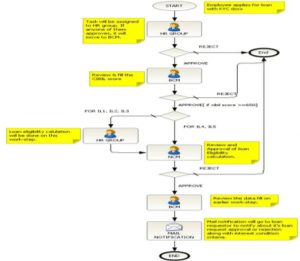

- Employee Loan Process, Reliance Capital Limited, India

Reliance Commercial had a need to automate the Employee Loan Process, so it can become an easy process for their employee and apply it electronically and let the concerned departments to handle properly.

The Client

Reliance Commercial (NSE/BSE Listed Company)

Industry

Financial Services

Challenges

Manually, it was very difficult for employee, as well as other key departments, to keep track of the loan request.

Solutions

The Employee Home Loan process includes all the steps starting from loan taker or requestor initiating the process by applying for a loan, till the time it finally gets the decision from Branch Credit Manager or NCM after a series of approval or rejections. Through this system, a loan requestor can fill the form online with all the relevant documents attached.

Process Model

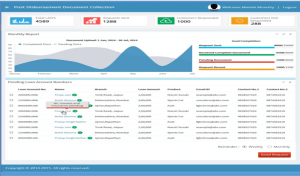

- Post Disbursement Document, Reliance Capital Limited, India

Reliance Commercial has a need to build a responsive solution for collections of post disbursement document from customer.

The Client

Reliance Commercial (NSE/BSE Listed Company)

Industry

Financial Services

Solutions

This application is developed by Pericent offshore team after all the functionalities related to the “loan management system” are fulfilled.

After the completion of “LMS”, this system helps in uploading all the relevant documents for the applied vehicle loan. The application is fully responsive in nature thereby allowing the users to access it from mobile as well.

Process Model and Screenshots

- E-Auction, Reliance Capital Limited, India

Case Study draft in process, would release soon, thanks for your patience!

- DSA Code Creation, Reliance Capital Limited, India

Case Study draft in process, would release soon, thanks for your patience!

- Centralized Disbursement Process, Reliance Capital Limited, India

Case Study draft in process, would release soon, thanks for your patience!

- Collection Repo and Disposal System, Reliance Capital Limited, India

Case Study draft in process, would release soon, thanks for your patience!

- Risk Bank Management, Reliance Capital Limited, India

Case Study draft in process, would release soon, thanks for your patience!

- Branch Review Management, Reliance Capital Limited, India

Case Study draft in process, would release soon, thanks for your patience!

- CAS Offline, Reliance Capital Limited, India

Case Study draft in process, would release soon, thanks for your patience!

- Collection Allocation, Reliance Capital Limited, India

Case Study draft in process, would release soon, thanks for your patience!

- e-Exit, Reliance Capital Limited, India

Case Study draft in process, would release soon, thanks for your patience!