Case Studies | Fintech

- Integrated Incentive Management Process - Niyogin, India

Implemented bpmEdge based solution “Automation for Incentive Management Process” for a Fintech company for managing the incentive payout given by applying incentive plans to input collected from the LOS system to their business partners around PAN India.

The Client

Niyogin Fintech Limited – BSE/NSE Registered Firm

Fintech finance company based at Mumbai, IndiaIndustry

FINTECH (NBFC)

Challenges

It was always very challenging and error-prone to manage, apply the plan and calculate the payout of incentives to the partners in a timely manner as per various incentive plans and status of loan application referred by the partner.

Solution

PERICENT BPM Team has implemented a complete end-to-end solution on top of the bpmEdge BPMS platform by integrating with Loan Origination System for the status of loans referred by the partners at the end of every month. The incentive amount gets calculated by applying various applicable incentive plans with help of a decision matrix, and business rules. After calculating the incentive amount it goes for multiple approvals and also let the approver split the payment to be paid to the partner if required. Then, the approved amount gets directly pushed into the bank for payment.

Business Benefits

Definitely, this solution has made it easy to manage the payout of incentives, which are well-calculated as per various incentive plans, which also reduced the human efforts and satisfied partners due to timely incentives payment.

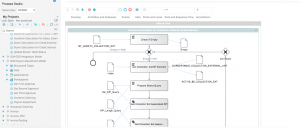

Process Model

Technology Used and Architecture

bpmEdge BPMS – A comprehensive business process and rules automation and management platform

- Purchase Order Generation Process, Niyogin Fintech Limited, India

Challenges

It was always a very challenging, time-consuming, and error-prone process for the generation of a purchase order manually as it requires a lot of checkpoints, budget approval, shortlisting of vendors based on various parameters depending on items to be purchased, and also multi-level approval.

The Client

Niyogin Fintech Limited, India

Industry

NBFC

Solutions

Pericent team has successfully implemented a solution for automation of purchase order generation process from collecting the quotation from the vendors, rating the vendor based multiple parameters, then taking it through multiple approvals and finally generating and emailing the approved purchase order to the selected vendor email address.

Business Benefits

This solution has automated the purchase order generation process reduced the human efforts, and time to process a purchase order.

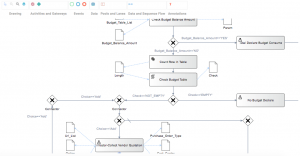

Process Model

Technology Used and Architecture

bpmEdge BPMS – Enterprise-class Business Process Automation and Management Platform

- Invoice Processing, Niyogin Fintech Limited, India

The customer also wanted to modify the invoices received from the vendors to release the payment in time.

Challenges

It is always a very challenging, time-consuming and error-prone process to process vendor invoices manually.

The Client

Niyogin Fintech Limited, India (NSE/BSE Registered)

Industry

FINTECH (NBFC – Unsecured Loan)

Solutions

Pericent has implemented a vendor invoice process application on the bpmEdge BPM Platform to timely process the invoices received from various vendors. Business Benefits

This solution has automated the purchase order generation process reduced the human efforts, and time to process a purchase order.

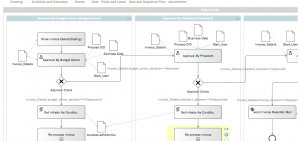

Process Model

Technology Used and Architecture

bpmEdge BPMS – Enterprise class Business Process Automation and Management Platform